Buyer 1-2-3

Here are the most frequent errors at the future buyers:...

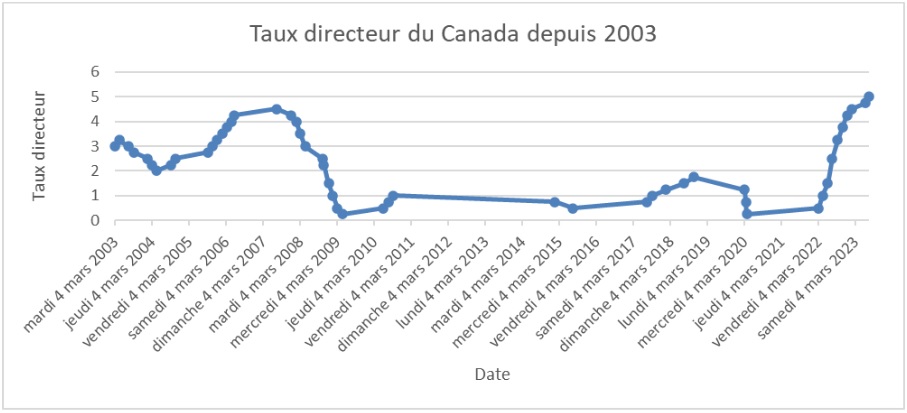

Canada has several tools to regulate its domestic market, including national monetary policy. A key element of this policy is the policy interest rate, which the Bank of Canada uses to promote economic growth and control inflation.

Understanding what this policy interest rate represents is essential. Additionally, the rate has varied significantly over the past two decades, so it’s essential to question the factors that determine these fluctuations. Finally, what is the impact of the policy interest rate on the economy and household finances? This article answers these questions and traces Canada’s policy interest rate evolution since 2003.

Some professionals will mention the target for the overnight rate, while others will refer to the policy interest rate. Despite the different terms, they refer to the same thing: the interest rate at which the government lends money to commercial banks through the Bank of Canada. The policy interest rate is the government’s primary tool to control inflation.

When the economy progresses too quickly, there is a risk of rising inflation. To slow this growth, the policy interest rate is increased. This leads businesses and individuals to pay higher interest on their loans. The effect of such a measure is to discourage borrowing and reduce spending to curb inflation. When interest rates are raised, individuals tend to spend less and save more, which slows down the economy.

Conversely, if the government notices that the economy is struggling to grow or declining, it can address this by lowering the policy interest rate. This, in turn, lowers other interest rates within the economy. Lower interest rates result in individuals spending more and taking out more loans, thus stimulating the economy.

The Bank of Canada, Canada’s central bank and a Crown corporation established in 1934, determines the policy interest rate. It uses the overnight rate target, or policy interest rate, to keep inflation around the target value of 2%.

Wednesday, September 4, 2024

-0,25

4,25

Wednesday, July 24, 2024

-0,25

4,50

Wednesday, June 5, 2024

-0,25

4,75

Wednesday, December 6, 2023

Wednesday, October 25, 2023

Wednesday, September 6, 2023

Thursday, July 13, 2023

Thursday, June 8, 2023

Thursday, January 26, 2023

Thursday, December 8, 2022

Thursday, October 27, 2022

Thursday, July 14, 2022

Thursday, June 2, 2022

Thursday, April 14, 2022

Thursday, March 3, 2022

Friday, March 27, 2020

Monday, March 16, 2020

Wednesday, March 4, 2020

Wednesday, October 24, 2018

Wednesday, July 11, 2018

Wednesday, January 17, 2018

Wednesday, September 6, 2017

Wednesday, July 12, 2017

Wednesday, July 15, 2015

Wednesday, January 21, 2015

Wednesday, September 8, 2010

Tuesday, July 20, 2010

Tuesday, June 1, 2010

Tuesday, April 21, 2009

Tuesday, March 3, 2009

Tuesday, January 20, 2009

Tuesday, December 9, 2008

Tuesday, October 21, 2008

Wednesday, October 8, 2008

Tuesday, April 22, 2008

Tuesday, March 4, 2008

Tuesday, January 22, 2008

Tuesday, December 4, 2007

Tuesday, July 10, 2007

Wednesday, May 24, 2006

Tuesday, April 25, 2006

Tuesday, March 7, 2006

Tuesday, January 24, 2006

Tuesday, December 6, 2005

Tuesday, October 18, 2005

Wednesday, September 7, 2005

Tuesday, October 19, 2004

Wednesday, September 8, 2004

Tuesday, April 13, 2004

Tuesday, March 2, 2004

Tuesday, January 20, 2004

The Bank of Canada’s policy interest rate is 5% as of October 27, 2023. It may have changed by the time you read this article.

The Bank of Canada sets the policy interest rate for its transactions with commercial banks. Individuals and businesses do not have access to this market. Interest rates, on the other hand, are set on loans granted by banks and other financial institutions. To avoid losing money, they must take the current policy interest rate into account, among other factors.

The Bank of Canada’s next policy interest rate will be set on January 24, 2024, during its first meeting of the year. The new rate will take effect on January 25. It’s important to note that the Bank of Canada meets eight times yearly: on January 24, March 8, April 12, June 7, July 12, September 6, October 25, and December 6.

You can follow the schedule of these events on the Bank of Canada’s website.

The policy interest rate is a powerful tool for regulating the economy and maintaining Canadians’ purchasing power. Depending on the needs of the Canadian economy, it helps to contain inflation or stimulate growth.

If you have a mortgage, it's a good idea to renew it at...

They trust us

1 an fixe

3 ans fixe

5 ans fixe

5 ans variable

7 ans fixe

As of 21/02/26

1 year fixed

3 years fixed

5 years fixed

5 years variable

7 years fixed